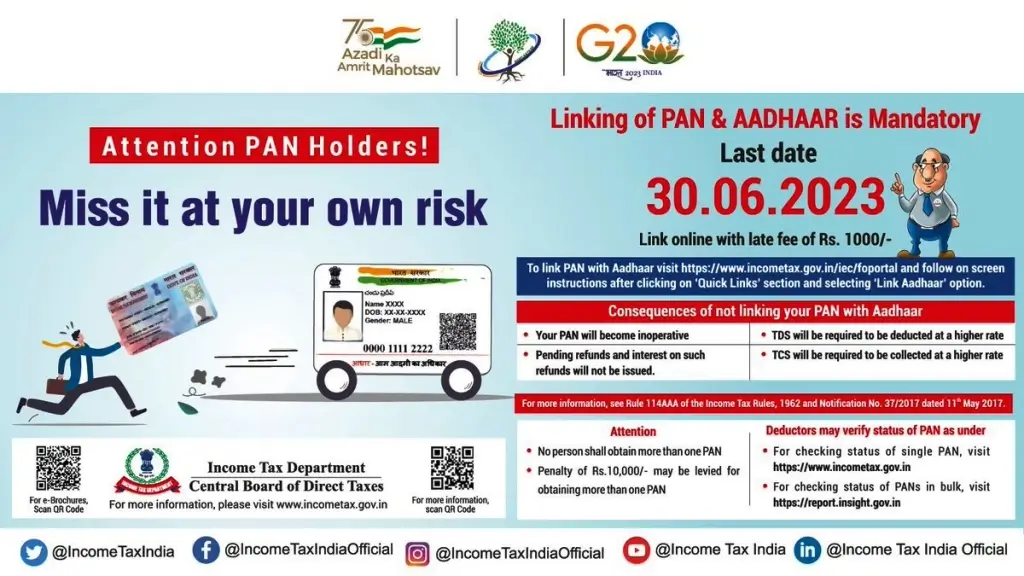

Link Your PAN Card With Aadhaar: It has been made mandatory to link your PAN card with Aadhaar. Your income tax return would not be processed if your Aadhaar is not linked with your PAN. Linking your PAN with Aadhaar is also indispensable if you are carrying out banking transactions for an amount of Rs.50,000 and above.

If the PAN card is not linked to Aadhaar, an individual will also not be able to invest in mutual funds, stocks or open a bank account among other things as furnishing a PAN card in all those cases is a must.

How to Link PAN Card with Aadhaar?

Linking a PAN card with an Aadhaar card is very simple and you can link your Aadhaar number with your PAN in any of the two ways:

Step 1: Using the SMS facility

Step 2: Use the facility on the e-Filing portal https://incometaxindiaefiling.gov.in

How to Link PAN Card with Aadhaar via SMS?

To link your PAN with your Aadhaar by sending an SMS, you need to follow the steps mentioned below:

Step 1: Type UIDPAN<12-digit Aadhaar><Space><10-digit PAN> on your mobile

Step 2: Send it to 567678 or 56161

Example: UIDPAN 123456789123 ABCDE1234F

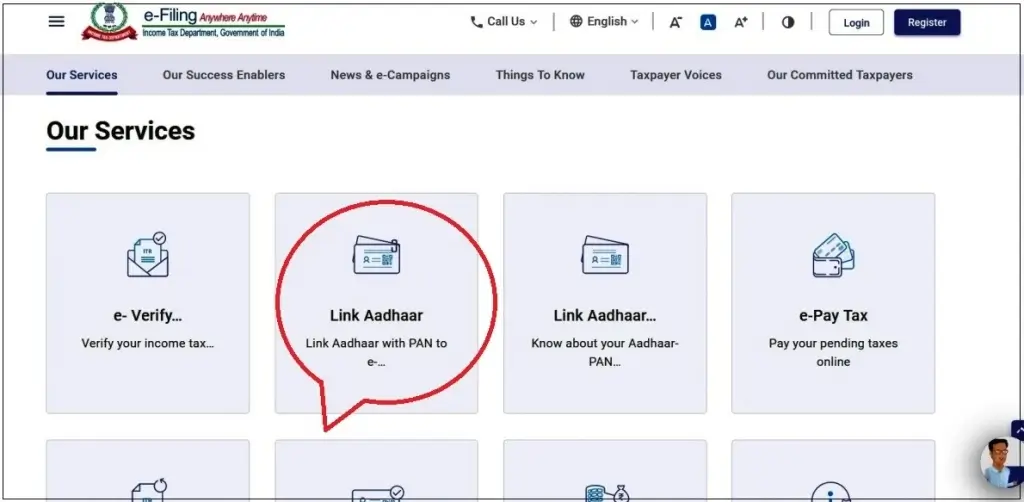

How to Link PAN Card with Aadhaar via Income Tax e-filing website?

Here is the procedure to link your pan card with your Aadhaar through Income Tax e-filing website

Step 1: Go to www.incometax.gov.in. Scroll down to reach the ‘Our Service tab.

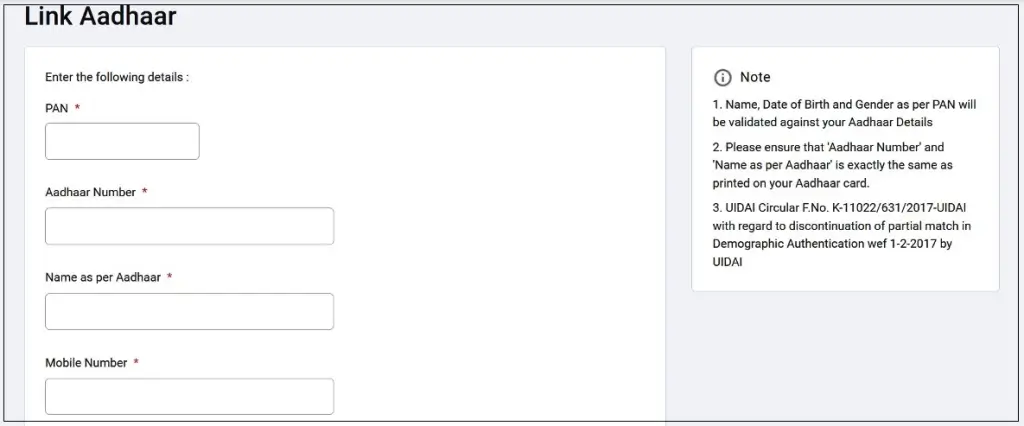

# PAN;

# Aadhaar no.

# Name as exactly specified on the Aadhaar card and

# Mobile number

In case only the year of birth is mentioned in your Aadhaar card, then select the check box asking “I have only year of birth on my Aadhaar card”.

Tick on the box that says, “I agree to validate my Aadhaar details”. It is mandatory to select this check box to proceed further with Aadhaar linking.

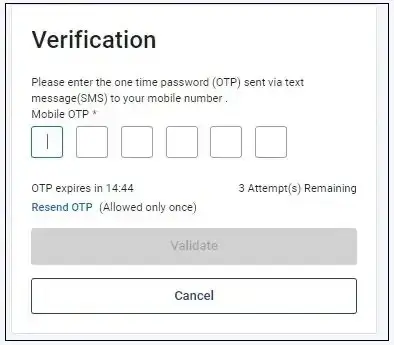

Step 3: Click on the “Link Aadhar” tab.

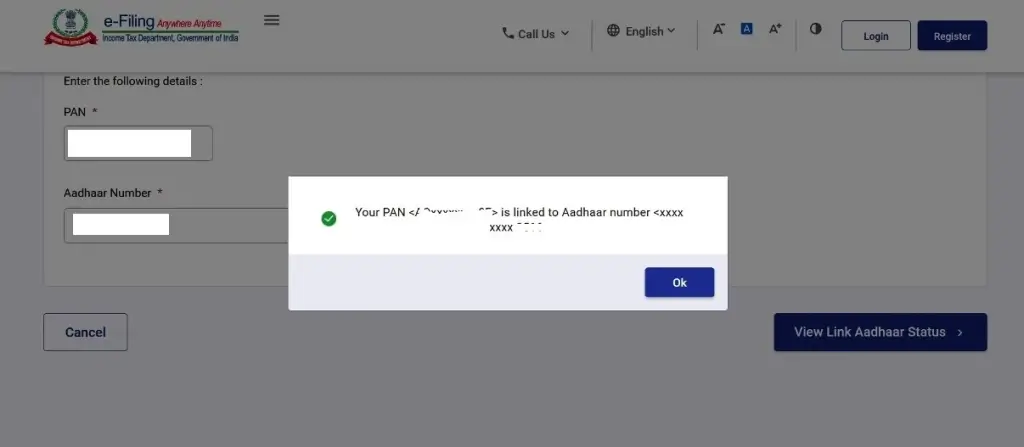

How to Check the Status of PAN Card Link with Aadhaar?

Here are the key steps to check whether your PAN Card is linked with your Aadhaar successfully or not.

Step 1: Visit the Income Tax Department’s official website and go to Aadhaar Status or click on the link incometaxindiaefiling.gov.in/aadhaarstatus.

Step 2: Enter your PAN and Aadhaar Number.

Step 3: Next click on ‘View Link Aadhaar Status’.

Important Web-Links of PAN – Aadhaar Linking

| Link PAN Card with Aadhaar | Click Here |

| Check PAN Aadhaar Link Status | Click Here |

| Official Website | Click Here |

The consequence of not Linking PAN – Aadhaar

An individual who does not link their Aadhaar card with a PAN card by 30th June 2023 stands to lose the operability of their PAN card. It is to be noted that a PAN Card is needed to fulfil Know Your Customer (KYC) norms from clearing houses to banks and even e-wallets. If a PAN card becomes, all these services will invariably be affected.

Even if you miss the deadline, you can still link PAN-Aadhaar but with a penalty of Rs 1,000 and other consequences as well.

An inoperative PAN card will affect one’s bank account savings as the interest earned on your bank account savings. The TDS (Tax Deduction at Source) levied on interest beyond Rs 10,000 annually will double to 20 per cent in the event of the bank not being linked to PAN Card. The TDS levied on interest beyond Rs 10,000 for bank accounts linked with PAN card is 10%.

Also, a penalty of Rs 10,000 may apply under Section 272B of the Income Tax Act, if you fail to link the two documents by the deadline and your PAN becomes inoperative and it will be assumed that your PAN has not been furnished as required by the law.